Repo Rate | What Is Reverse Repo Rate Yadnya Investment Academy

Repo rate is a powerful tool used by Indias central bank the Reserve Bank of India RBI to maintain liquidity in the market and manage cash flow. 4 rows REPO rate is the rate of interest at which the central bank of India ie.

Repo Rate Vs Reverse Repo Rate Top 5 Differences With Infographics

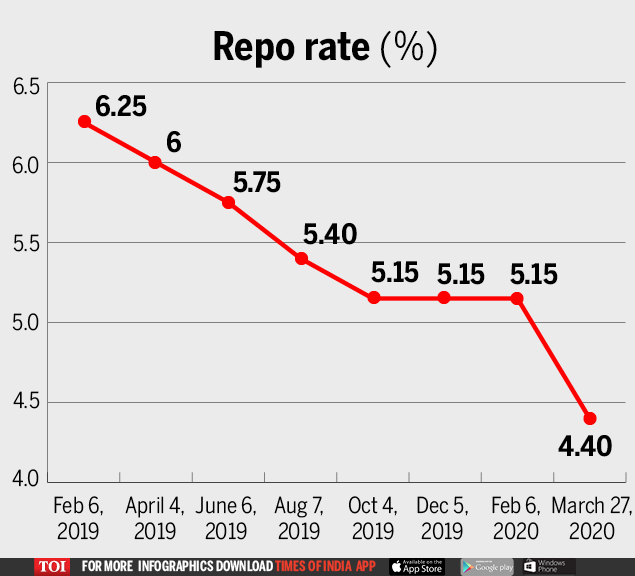

Hence the repo rate will continue to be 4The reverse repo rate has also been maintained at 335.

Repo rate. Of the many roles to be played by it the chief functions of Reserve Bank of India RBI are to regulate the economy supply or money supply in the financial budget also known as the cost to credit. The official interest rate is the repo rate. In simple language RBI controls the availability of money for an industry.

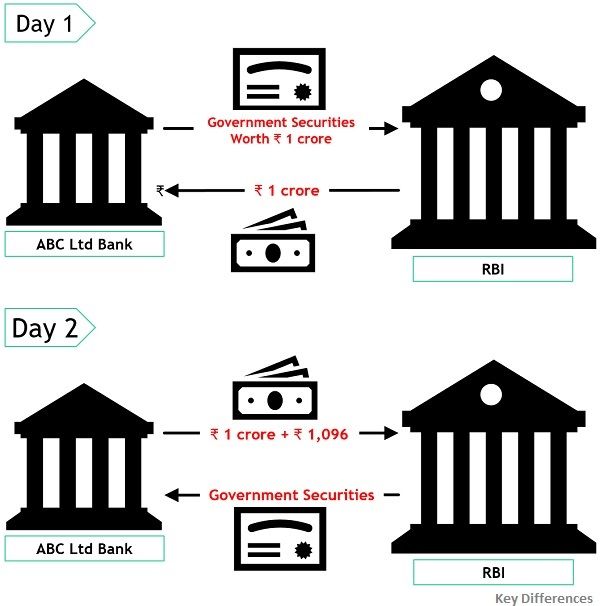

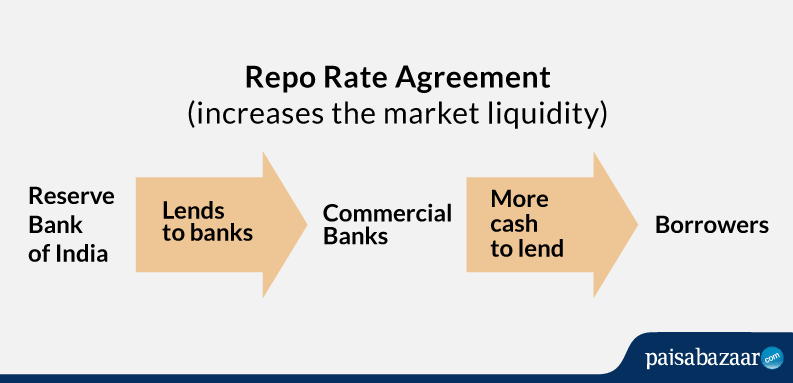

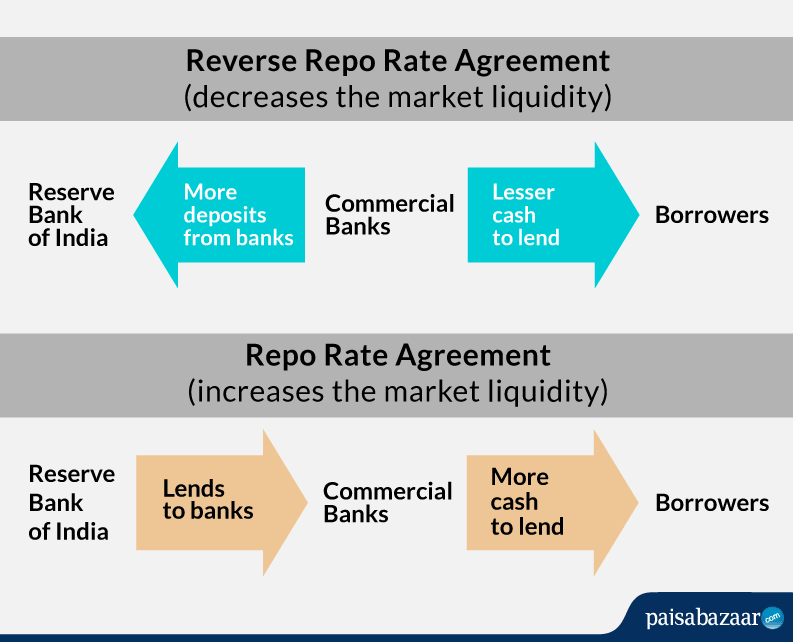

Repo rate is used by monetary authorities to control inflation. Repo rate or repurchase rate is referred to as the rate at which the central bank RBI lends money to the commercial banks for meeting short-term fund requirements in order to maintain liquidity and control inflation. Repo Rate meaning.

That way the money supply in the economy is reduced. In order to counter inflation excessive growth of the available funds money must be prevented. Repo Rate or repurchase rate is the key monetary policy rate of interest at which the central bank or the Reserve Bank of India RBI lends short term money to banks.

If RBI wants to make it more expensive for the banks to borrow money it increases the repo rate similarly if it wants to make it cheaper for banks to borrow money it reduces the repo rate. Reference rates play several important roles in financial markets that support efficient market functioning. Understanding Repo rate Reverse Repo rate CRR SLR Base Rate.

Reserve Bank of India. The more the repo rate the costlier are the loans for the customers. When the repo rate increases borrowing from RBI becomes more expensive.

The repo rate short for repurchase rate is the interest rate determined by the South African Reserve Bank SARB at which the private sector banks are allowed to borrow money from the SARB. According to high frequency indicators economy has been recovering owing to multiple triggers. Repo Rate - The fixed interest rate at which the banks can borrow money from the RBI by lending their surplus government securities is known as the Repo Rate.

Repo Rate in the United States averaged 223 from 1995 until 2021 reaching an all time high of 694 in September of 2019 and a record low of -001 in December of 2009. The repo rate refers to the amount earned calculated as net profit from the processing of selling a bond futures contract or other issue and subsequently using. The repo rate system allows governments to control the money supply within economies by increasing or decreasing available funds.

Repo rates are used to control instances like inflation whereby the reserve bank of a country increases the rate making it a disadvantage for the commercial banks. Hence the issue of inflation is brought under control. It can be used to combat inflation recession induce cash.

When reference is made to the South African interest rate this often refers to the repo rate. Below is a detailed insight into this concept and related aspects. SARB repo interest rate.

This base rate is also called the repurchase rate. Put differently the repo rate is the interest rate at which the South African Reserve Bank SARB is willing to extend credit to private banks in the country. The United States Overnight Repo Rate increased to 006 on Friday November 12 from 005 in the previous day.

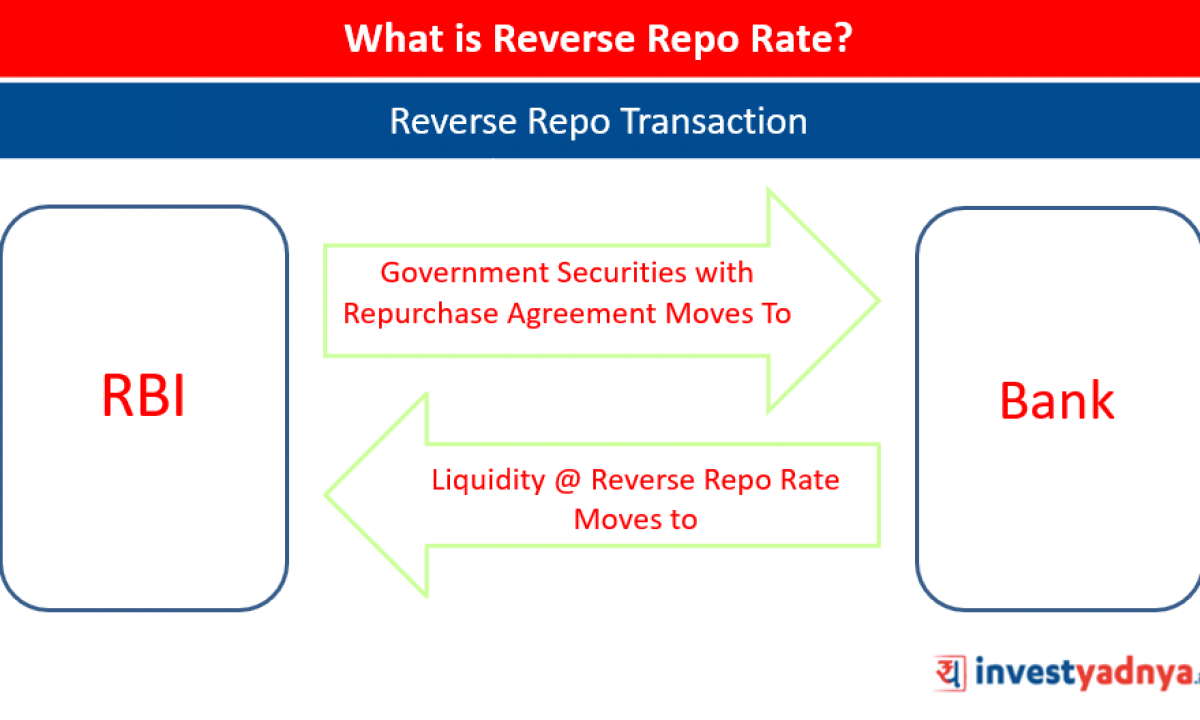

The BI 7-Day Reverse Repo Rate instrument was introduced as the new policy rate due to its rapid influence on the money market banking industry and real sector. 21 rows Key Repo Rate. The repo rate is the rate at which the central bank of a country in this case SARB lends money to commercial banks in the event of any shortfall of funds.

The Monetary Policy Committee MPC of the RBI convenes bi-monthly to make changes to the repo rate according to economic conditions. This is the rate at which central banks lend or discount eligible paper for deposit money banks typically shown on an end. Furthermore the BI 7-Day Reverse Repo Rate as a new reference rate has a stronger correlation with money market rates is transactional and encourages financial market deepening particularly through the use of repo instruments.

The New York Fed produces a number of reference rates that provide insight into the dynamics of money markets which is useful for evaluating the effectiveness of monetary policy implementation. The RBI has decided to maintain the status quo and hasnt changed the repo rate. In essence the repo rate is used by.

Repo rate also known as the benchmark interest rate is the rate at which the RBI lends money to the banks for a short term. Repo rate is the rate at which the central bank of a country Reserve Bank of India in case of India lends money to commercial banks in the event of any shortfall of funds. Repo and reverse repo rate.

The repo rate is the interest rate at which the central bank of the country RBI in India lends money to the recognized commercial bank to achieve several fiscal goals for the economy. Definition of Repo Rate.

What Is Repo Rate Definition Of Repo Rate Repo Rate Meaning The Economic Times

Difference Between Repo Rate And Reverse Repo Rate With Examples Similarities And Comparison Chart And Similarities Key Differences

Rbi Rate Cut Rbi Reduces Repo Rate By 75 Basis Points To 4 4 Key Points Times Of India

What Is Repo Rate Yadnya Investment Academy

What Is Repo Rate The Financial Express

Explained Repo Rate S Effect On Personal Loan Interest

Difference Between Repo Rate And Reverse Repo Rate With Examples Similarities And Comparison Chart And Similarities Key Differences

Diganta Com Difference Between Repo Rate And Reverse Facebook

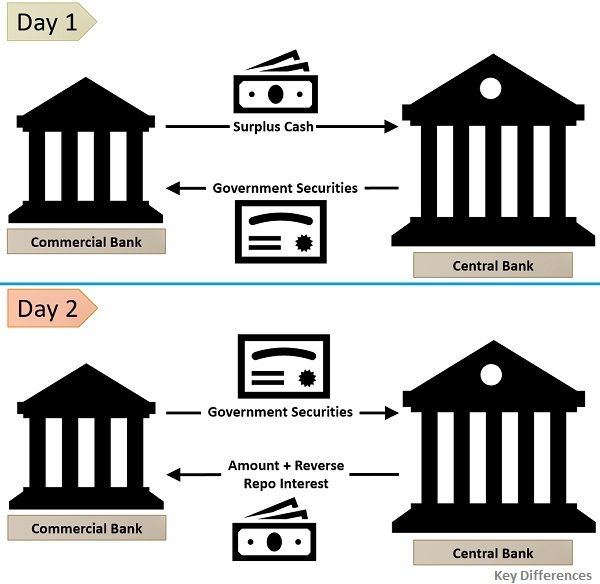

Reverse Repo Rate Meaning Historical Rates Chart And Impact On Loans Deposits

What Is Reverse Repo Rate The Financial Express

Repo Rate Definition Everything You Need To Know About It

What Is Reverse Repo Rate Yadnya Investment Academy

Rbi Repo Rate Repo Rate In India Repo Rate Trend Paisabazaar

Repo Rate Vs Reverse Repo Rate Definition Significance Effects

Repo Rates The Essential Factor For Economic Growth Of The Nation

Repo Rate Meaning Historical Rates Chart And Impact On Loans Deposits 1stopinvestment Com

Post a Comment

Post a Comment